I like to have my budget broken down into very specific categories, but I totally understand that that can feel a bit overwhelming for some people. Maybe you want to go back to basics with super simple budget categories.

Using just 3 simple budget categories can give you more flexibility in your spending.

There’s no right or wrong way to set up your budget categories, so if you find that fewer categories works best for you, do that!

3 Simple Budget Categories:

1. Fixed

Your first budget category is for all of your fixed expenses. These are the bills and expenses that don’t change from month to month.

You don’t need to estimate how much you will spend on your fixed expenses because you always know how much your bill will be.

Here are some expenses that fall into this category:

- Rent or Mortgage Payment

- Car Payment

- Minimum Debt Payments

- Internet Bill

- Phone Bill

- Life Insurance

- Homeowner’s or Renter’s Insurance

- Utility Bills (if you have them on a budget plan that keeps them the same each month)

- Day Care or School Fees

Your fixed expenses are also all considered necessities.

Your gym fee and Hulu membership are probably the same amount each month, but I’d consider them “Extras” since they’re definitely more wants than needs.

2. Variable

Variable expenses are still important necessities, but the amount can change each month.

Here are some expenses that fall into this category:

- Groceries

- Household Items (like toilet paper, lotion, cleaning supplies, etc.)

- Gas

- Medical Costs (for copays or prescriptions)

- Pet Costs

- Vehicle Costs (maintenance, parking fees, etc.)

- Home Repairs

You have control over these expenses, which makes them a great place to look if you want to save money.

3. Extras

The Extras category includes anything that’s not necessary to your survival. Some of these costs remain the same each month (like your gym membership) while others are variable (like gift giving).

Here are some expenses that fall into this category:

- Extra Debt Payments (your minimums were included in the Fixed category)

- Savings

- Eating Out

- Clothing & Shoes

- Holidays & Birthdays

- Vacations

- Gym Memberships

- Cable or Streaming TV Services

- Fun Activities

- Memberships or Subscription Services

How to Set Up Your Simple Monthly Budget:

If you’re looking to set up a monthly budget using these simple budget categories, let’s walk through how to do it.

1. Figure out your monthly income.

Look back at your paycheck stubs to determine how much money you bring home after taxes and other paycheck deductions.

If you have an irregular income, look back over the last few months or a year and come up with a low average amount that you bring home.

2. Gather your Fixed category expenses.

Add these up to come up with your budgeted amount for your Fixed category.

Subtract this from your income to see how much money you have left over to dedicate to your Variable and Extras categories.

3. Estimate all of your Variable expenses.

Since the amounts in this category can change from month to month, do you best to come up with an estimate for how much you spend on your variable costs.

Look back at bank or credit card statements to get a better idea of what you’ve spent in the past. Come up with the amount you want to budget for all of your Variable expenses. Subtract this from your total from step 2.

4. Leftovers!

Whatever you have left after subtracting your Fixed and Variable budgeted amounts from your income is what you have left for your Extras.

You can use this money to pay off debt, save, or spend on the less necessary expenses in your life.

5. Track and adjust.

Creating a budget is never a “one and done” kind of activity. You’ll want to track your spending to see if you’re on track with each of your three simple budget categories throughout the month.

If things aren’t working out quite as you’d planned, make adjustments to your simple budget for next month and give it another go.

You can download my free expense tracker printable to help with this part:

[convertkit form=980628]

Don’t Miss These Related Budgeting Posts:

- 9 Budgeting Myths That Are Holding You Back

- 18 Sinking Fund Categories You Might Need in Your Budget

- How to Live on $2500 Per Month: A Real Budget

- 55 Budget Categories to Think About

- How to Stay Out of Debt

Other Budget Setups:

There are other common budget setups you can use other than the Fixed, Variable, Extras method I just explained.

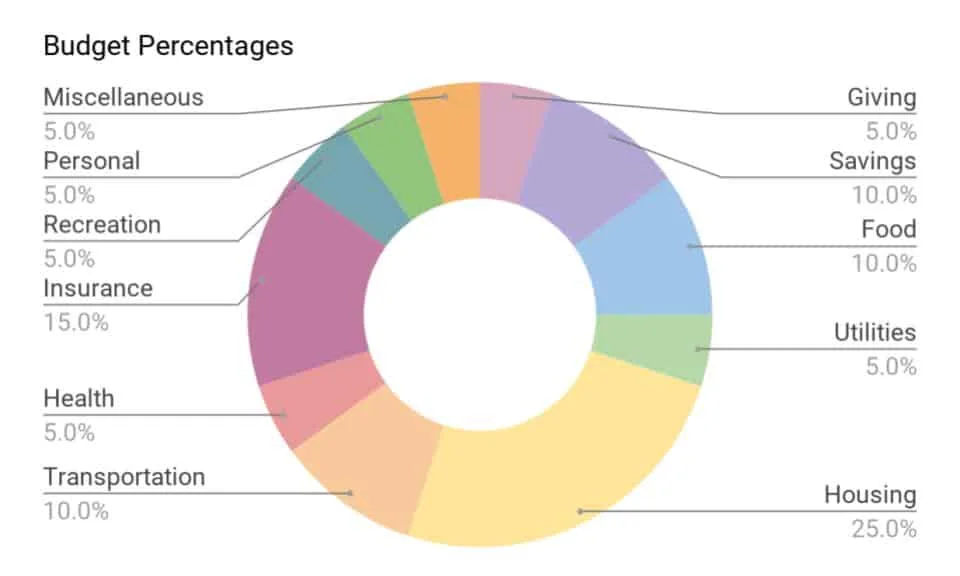

Recommended Percentages

You can look at your income and divide your spending based on some recommended percentages. I think this is a great way to get started, though you’ll definitely have to make adjustments based on your unique situation.

Here are some recommended percentages to get you started:

- Giving: 5%

- Saving: 10%

- Food: 10-15%

- Utilities: 5-10%

- Housing: 25-30%

- Transportation: 10%

- Health: 5-10%

- Insurance: 10-20%

- Recreation: 5-10%

- Personal Spending: 5-10%

- Miscellaneous: 5-10%

I’ve got a post that goes into a lot more detail on this method and breaks down the amounts based on a few different income levels if this sounds interesting to you.

The 50/30/20 Budget

The 50/30/20 Budget is all about needs, wants, and savings. You still only have three simple budget categories, but it’s broken down a bit differently:

- 50% Needs. This means half of your after tax income should go to important things like groceries, housing, insurance, and utilities.

- 30% Wants. This portion of your income goes to less necessary costs, like eating out, clothing, or cable.

- 20% Savings or Debt Payments. 20% of your income should go to either paying off debt (your minimum payments came out of your Needs section, so this is extra) or long-term savings.

You can find out more about the 50/30/20 method at a website called The Balance.

Budget categories can be as simple or as detailed as you want. It’s all about what makes the most sense to you!

I prefer to be quite detailed because it makes me feel more in control of our finances, but I can see how simple budget categories would feel more flexible and less constrained. If that’s what works best for you, keep it simple!