Have you ever experienced frugal burnout?

Maybe you didn’t have a name for it, but after trying to stick to a budget or save money for a while, you just got totally sick of being frugal. I’ve been there! I want to talk about two sides of dealing with frugal burnout:

- How to avoiding getting burnt out.

- How to get back on track if you do get burnt out.

Ideally, we will use the strategies below to stay energized and motivated in our frugal living endeavors and we will never reach burnout. Of course, life doesn’t always go as planned, so that’s why we’ll also figure out what to do if you are totally burnt out.

You can watch the Facebook live video I did about frugal burnout below:

How to Deal with Frugal Burnout

What is it?

Frugal burnout is basically when you’ve been putting in a lot of effort to be frugal and you are just over it! It’s hard to make changes and sacrifices, especially for extended periods of time.

It could be that you’re trying to pay off debt and are putting every extra penny towards payments. Maybe you’re saving for a down payment on a house. Or possibly you have to be extra frugal just make ends meet. We’ve experienced all three of these!

The problem is, when you get burnt out you feel like you just don’t care anymore. You’re sick of tracking your spending, denying yourself the things you want, and constantly having to delay gratification.

It could lead to a shopping spree, a weekend trip, or some other dicey financial decision, which hurts your progress toward your goals. It’s rough.

So how can you avoid getting to the point of being totally burnt out?

Avoiding Frugal Burnout

Redefine What Treats Are

Treating yourself is a helpful way to avoid burnout. However, you might have to redefine what your treats are. Often when we do something regularly it ceases to be considered a treat, it’s just something we get or feel like we deserve.

When you’re working hard at being frugal, it helps if you can think of even the smallest things as treats. It’s all in how you think about it. Treats do not have to be expensive or cost any money at all!

If getting manicure was such a normal part of your routine that you didn’t even considered it a treat, it’s going to be hard to treat yourself inexpensively. If you give up those manicures completely to save money, then maybe getting one every once in a while is a great treat for you. For even less money, you could do your nails at home. Buy some new polish and turn on some spa music and it really starts to feel special, right?

Going out for ice cream is a fun treat. You can also consider buying a tub of ice cream and eating it at home a fun treat. It’s all in how you think about it.

Frugal Treats!

Part of what causes frugal burnout in my experience is feeling like we’re denying ourselves constantly for such a long period of time. If we give ourselves regular treats, our lives don’t feel so sparse and colorless. The trick is coming up with inexpensive treats.

Here are some frugal treat ideas:

- Hit the Dollar Store! Let everyone in the family pick out a toy or snack.

- Ice Cream at Home. It’s much cheaper than going out. If you buy cones, it becomes really exciting.

- Step Up Your Coffee Game. Get some flavoring or special creamer to make your at-home coffee feel a little fancy.

- Get Dressed Up. Do your hair and makeup. Put on an extra-cute outfit. You don’t need a reason!

- Bake Your Favorite Dessert. Homemade baked goods are the best!

- Do a Homemade Face Mask or Hair Mask. You’ve got everything you need in your kitchen. Google some recipes!

- Take an Extra-Long Hot Shower. Or a bath…

- Do Your Nails. Make it social with a friend or daughter.

- Turn on Your Favorite Music.

- Take a Nap.

- Put on Perfume. If you usually save it for a special occasion, wear perfume on a normal day around the house.

- Buy Flowers. Look for inexpensive grocery store flowers. They usually last a whole week for less around $5!

- Color in a Coloring Book. It’s all the rage for adults these days.

- Family Dance Party. Turn on some fun music and jump around!

- DONUTS. My all-time favorite, less than a dollar treat!

Talk to Like-Minded People

It really helps to talk to people who are working on some of the same goals that you are. If you’re surrounded by friends who are constantly splurging and spending gobs of money while you’re trying to stick to a tight budget, it can feel discouraging.

Seek out friends and family to spend time with who are also frugal. Plan inexpensive activities you can all do together!

If you don’t have any family or friends who understand your frugal living, go online! So many people find support through various Facebook groups and blogging communities. It will give you a place to discus your goals and share frugal living tips.

Of course I recommend The (mostly) Simple Life Community group. I’m also part of a Dave Ramsey Facebook group that is really great.

Celebrate Small Victories

Don’t wait until you hit your big goals to celebrate! Have mini celebrations at landmarks along the way.

If you’re paying off a whole mountain of debt, celebrate each individual debt paid off or every time you pay off another $500. Use one of the frugal treat ideas listed above or splurge a little on a nice dinner out, whatever makes sense for your budget.

When we paid off our car a few months ago, I set aside an extra $50 so that we could celebrate. Yes, we could have put that $50 towards the debt we still had remaining, but celebrating the victories along the way is part of what keeps us motivated and excited about our progress! It’s like a small taste of what’s to come once we get all of our debt paid of.

If you’re just trying to scrape by each month, celebrate being able to pay all of your bills. Celebrate not going further into debt. Celebrate sticking to your budget. If there’s not a penny to spare, celebrate in a free way.

Allowance $$$

Setting an allowance for yourself and your spouse can be a great way to keep from feeling burnt out. (We call it allowance money, other people call if fun money or blow money.)

Basically, our allowance money can be spent however we want, no questions asked! Video games, jewelry, craft supplies, donuts, etc. It’s especially for anything that we don’t normally budget for or things that are just for us.

I don’t buy jewelry out of our family’s monthly budget because it’s something fun just for me and is definitely not a need. If I buy myself some cute earrings, it comes out of my allowance money. It’s the same for Austin and his video games.

Having our allowance money set aside makes each of us feel like we’ve got some spending money that we can do whatever we want with.

Currently, we budget $20 each month for our allowance money (It used to be $10). That might not seem like much, I know some people budget more like $100 per week per spouse, but it works for us and for our budget. It doesn’t have to be a huge amount to make you feel like you have some freedom and wiggle room for fun stuff. (https://godaddy.com/)

Keep a “Frugal Fun” List

Keep an ongoing list of frugal ways to have fun! We don’t mind sticking to a tight budget or being extra frugal when we’re still having fun. And there are always plenty of free ways to have fun. For when you’re not thinking too creatively, it helps to have an actual list of ideas to look at.

Here’s a list of free activities to get you started.

Getting Back on Track

If you are totally burnt out on being frugal and past wanting to throw in the towel, it’s time to take a deep breath and get back on track. You can do this. It will be worth it.

Pinpoint Your Specific Goal

Make sure you know exactly what you’re working towards.

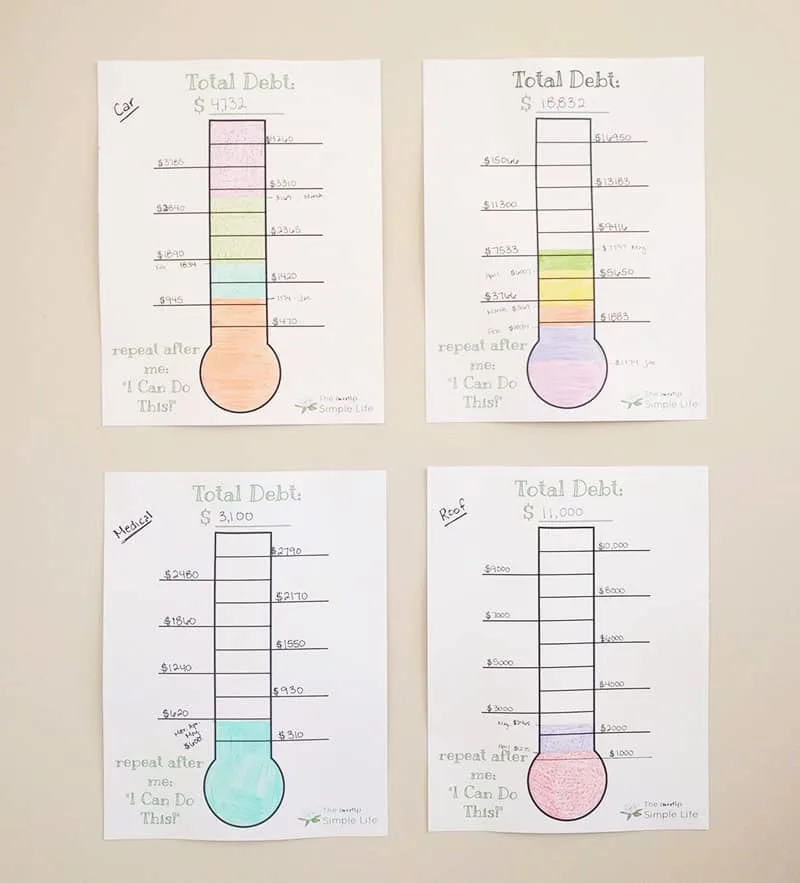

If you’re trying to pay off debt, make sure you have your debts written down so that you can see exactly what you’re working on.

If you’re trying to save towards a house, what specific amount of money are you trying to reach? Just saving as much as humanly possible is vague and can leave you feeling guilty for even buying things you need, like groceries. Setting a specific amount gives you a concrete goal to work toward.

If money is crazy tight, your goal might be pay all of your bills this month or to have $20 left over at the end of the month. Those are absolutely great goals! We’ve been there.

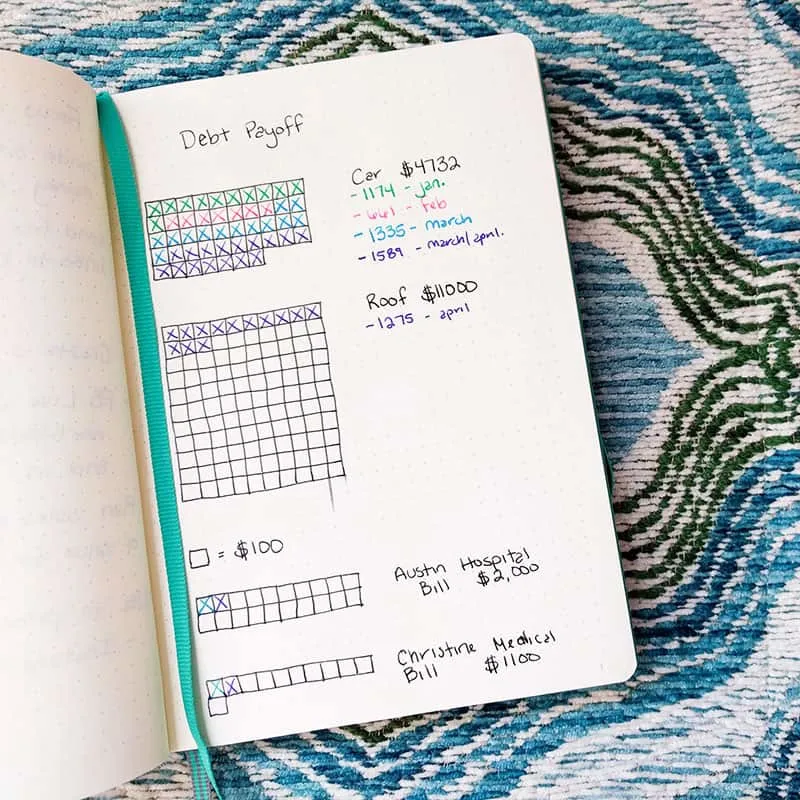

Set Mini Goals Along the Way

Remember the part about celebrating small victories? Set some mini goals so that you have small victories to celebrate! Since you’re feeling burnt out, reaching a mini goal and having something to celebrate will renew your excitement and motivation for the larger goal.

Set mini goals like:

- Having $20 to save at the end of the month.

- Putting an extra $50 on a debt payment.

- Packing your lunch every day for a week.

Use Visual Motivation

I love having a way to visualize our goals. I first did this when we were saving to pay cash for Austin to go back to college. We had estimated how much cash we would need and I made my first savings thermometer. Man, was that motivating to see our progress!

Right now I use two different visuals for paying off our debt. I created a debt payoff thermometer that I color in each month when we make payments. Enter your info below and I’ll send you one that you can use yourself!

[convertkit form=5049336]

I also have a bullet journal that I listed our debt in. I cross of a box for every $100 we pay. Being able to see all of our debt in one place and watch us get closer to paying it off has kept me motivated this year!

Remember Why

There is a very good reason for why you are living frugally, isn’t there? Take a few minutes and dig deep into why you’re doing what you’re doing. How is it going to make your life better? Why does it matter to you?

When we saved for Austin to finish his degree, I dreamed of him having a career he enjoyed. Everyday he went to work at jobs he hated and it wore on him. I saved because I wanted better things for him and our family.

Right now, we’re paying off all of our debt so that we can save up to buy a house on a lake, a dream we’ve had since our first year of marriage. I can visualize us on the deck after work sitting by the lake. I can’t wait!

When we were barely scraping by, my “why” was because I didn’t want to stress about money. We didn’t have much, but if we could keep our bills paid and save a little bit, it would keep extra weight off of our shoulders and give us options in the future.

Don’t forget why you’re being frugal.

I’ve experienced frugal burnout multiple times. It’s usually when I’m feeling overworked, tired, and like I haven’t done anything fun in a while… Ugh. Now I use these strategies to get myself back on track and to help avoid burnout in the future.

You Might Like These Posts Too:

- 101 Money Saving Tips

- Our Debt Free Journey Update: The Impossible Might Happen!

- How to Live on $2500 Per Month

- 19 Expenses to Cut From Your budget When Money is Tight

⇒ Have you experienced frugal burnout? Let me know in the comments!

Debt Free Journey Update #2: Makin' That Money, Honey! - The (mostly) Simple Life

Monday 9th of July 2018

[…] How to Avoid Frugal Burnout […]