No matter what you spend on groceries, I’m guessing you’d be ok with finding a few ways to save.

Groceries are the second highest expense in our budget, just after our rent. I budget $55-60 per week for the two of us, which is $220-240 per month.

(That’s just for groceries. We budget for other home products and eating out separately.)

So, super interesting: I found the USDA averages for what families spend on food. Apparently, we spend below what is considered the “thrifty” plan, which is $381.90 per month for a family of two adults. (Feb. 2017 chart)

The “moderate-cost” plan would be spending $618.40 per month! I’m sure a lot of your spending depends on where you live and any special diets or allergies, though.

You can take a look at my 13 secrets to saving money on food. I’ve also come up with these grocery shopping strategies that can keep costs low.

10 Money Saving Strategies for the Grocery Store

1. Shop Once a Week

Shopping once a week (or less) can save a ton of money.

Every time you stop for one or two things, you’re likely to grab a few extras that weren’t on your list. Those extra purchases add up very quickly.

Shopping once a week gives you less of an opportunity to make impulse purchases which might save you way more money than you realize.

When we lived far from the stores, I would go once a month to buy almost everything I needed for the whole month. Then, once a week, I would make a quick stop just to buy fruits and veggies for the week. It took some significant planning to meal plan for the whole month, but I was able to keep our grocery bill very low.

Now that we live in a bigger city, I make my meal plan for the week and only go shopping once a week.

2. Budget & Divide the Budget

How can you know how much you’re spending on groceries unless you keep track? If you get to the end of the month and have no idea where all of you money went, you might want to keep track of your grocery store receipts.

I keep our grocery budget separate from the amounts that I budget for eating out and household products because I like to have a more accurate number of what we spend on food at home.

When I budget for the month, I will budget something like $240 for groceries for the month, but then I divide that number so that I know how much I should spend weekly to stay on track. I know I have $60 per week to spend on food in order to stay on track with the budget. It’s best not to “borrow” from next week’s money or else you’ll get to the last week in the month and have nothing left.

However, sometimes I stock up on things in bulk or on sale at the beginning of the month. If I spend $120 for the first week because I stocked up, then I divide the rest of my grocery money by three, so that I know I need to only spend $40 per week for the following weeks.

I usually do this if I can stock up on meat at a good price, which makes it pretty easy to stay on budget because I only need to buy fruits, veggies, and a few other things for the rest of the month.

Related Posts:

Our Actual Budget: Less Than $1500/Month

The Simple Way We Track Our Spending on a Tight Budget

3. Calculate

You might not realize how much groceries cost when you’re just grabbing your usual items and throwing them in your cart. An amazing way to save and become more aware of what you’re buying is to calculate as you go.

Now you don’t have to walk around with a calculator and perfectly add up each item (unless you want to). Roughly adding things up in your head will help. I love the idea of using a tally counter. Just round the prices up or down and click it once for each dollar.

If you’ve got kids grocery shopping with you, they can help (education, yo!).

4. Check Savings Apps Before

There are some great money saving apps out there and they’re so easy to use! You’re missing out if you’re not taking advantage of them.

My favorite is Ibotta because you can save money on fruits, veggies, and store brand foods as well as the name brand stuff. I like to check it before I go to the store in case it means I should buy the name brand of something because of a rebate or in case I can get a rebate for fruits or veggies I would like but wasn’t planning on buying.

I’ve created a tutorial showing exactly how to use Ibotta for saving money on fruits, veggies, and non-name brand items.

Click here to download the Ibotta app and start earning cash back! You will automatically get $10 the first time you submit for a rebate.

5. Check Sale Ads

While I’m making my meal plan and grocery list, I like to go online and check the sale ads for a few stores close by.

I usually try to only go to two stores because I value my time and sanity. By checking a few sale ads, I can decide which stores it makes sense to go to based on how many of the things I need are on sale at each one.

Also, it’s best to plan your meal around what’s on sale instead of getting whatever sounds good. Why plan to make a roast and pay full price for the meat when there’s a great sale on chicken? This strategy will save a ton of money and doesn’t take much time.

6. Meal Plan

I know you know you should, but are you doing it? Seriously!

To only shop once a week, you need a plan. All of those extra trips of the store that are probably costing you extra money are happening because you didn’t plan well enough.

Tip: While you’re planning your meals for the week, you’ll save a ton if you include a few extra cheap meals. Meatless meals are especially inexpensive: think spaghetti, eggs and pancakes, or bean and cheese quesadillas.

UPDATE: You can get the meal planning printable I use each week by entering your info below!

[convertkit form=830245]

7. Don’t Pick from the End Cap

Grocery stores use all kinds of tricks to get you to spend more money.

Sometimes, what looks like a good deal on the end cap (the short bit of shelves at the end of an isle) isn’t so great.

The store is betting that you’re in a bit of hurry and instead of looking through the whole cereal/soda/whatever section, you’ll just grab what’s on the end cap because it’s quick, easy, and it looks on sale.

A lot of times there is a better deal if you go to actual section and look at store brands or other sales.

8. Plan a Treat

8. Plan a Treat

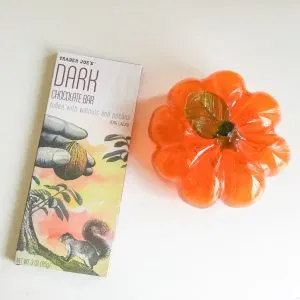

Grocery shopping is hard work! As a reward for meal planning, sale shopping, and sticking to my tight budget, I like to plan for a treat.

Something little like a piece of dark chocolate can make me feel less restricted when we’re trying so hard to spend less.

When you get a little treat here and there, it can keep you from feeling frustrated with your tight budget and totally blowing it on a whole bunch of treats and convenience foods.

9. Dinner Tonight

After I’ve gone grocery shopping, I have no desire to go home and cook a big meal. It’s ridiculous because we have tons of food in the kitchen, but I’m just over it.

In my meal plan, I try to plan for something super easy to make for the day I grocery shop. If everything on my meal plan takes too long, I’ll probably order takeout even though I know I shouldn’t.

Dinner on the day I go grocery shopping is often frozen pizza, rotisserie chicken, or the frozen chicken cordon bleu from Aldi that you can just put in the oven. It’s super easy and still much cheaper than takeout.

Related Posts:

13 Secret to Saving Money on Food

How to Earn Cash Back on Fruits, Veggies, and Store Brand Foods

10. Sometimes a Good Deal Isn’t a Good Deal

I like to keep a fairly well-stocked pantry. I don’t have a year’s worth of food or anything, but I like to always have a supply of the ingredients I use the most.

A great way to build up your pantry is to stock up when an item is on sale.

However, a good deal isn’t a good deal if you don’t have the money for it. I learned this when we were first married and had an insanely tight budget. There would be weeks that I wouldn’t look at the sale ads because no matter how good a deal was, I didn’t have the money to spend.

Getting food at a great price still means that you’ve spent something. If you’re putting groceries on a credit card that you can’t pay off or you’re determined to stick to your grocery budget, no deal is good enough unless it’s free.

Because groceries are one of our biggest monthly expenses, it can make a huge difference in our budget if we work hard to save money at the grocery store.

These 10 strategies can help keep your grocery spending under control so that you can spend your hard-earned money on other things.

⇒ What are your strategies for saving money at the grocery store? How much do you spend on food per month? Interesting, isn’t it?

34 Great Goals to Set to Change Your Life - The (mostly) Simple Life

Wednesday 23rd of November 2016

[…] Lower your grocery bill by 10% (find tips to save money on food here and here) […]

Erin | A Welder's Wife

Monday 21st of November 2016

These are really good tips! I find that I save money by grocery shopping Monday-Wednesday. These are the slowest days for grocery shopping, but a lot more items are marked down getting ready for Thursday-Sunday are when everyone usually shops. I have saved a lot of money on meat doing this, because stores want to put out "fresh" meat for the upcoming busier days.

Christine

Monday 21st of November 2016

Wow, I didn't know that! I'll have to try that and see if I can find some deals. Thanks Erin!

Heather

Friday 11th of November 2016

Hey Christine,

I popped on over from Pinterest. This is a great list! I do most of your tips and have found that another way we save money is by taking advantage of curbside pickup at our local grocery store. It's great because I order all my groceries online and set up a time to pick them up. This makes me stick to my list, so I tend to spend less.

I also love coupon clipping (paper and digital) and the apps for after shopping.

I chuckled when I read the "dinner tonight" tip because I am the same way. Who wants to cook when they've done the meal planning, shopping and putting away of the groceries? It's usually pizza for us too,

Thanks for the tips!

Christine

Saturday 12th of November 2016

Thanks Heather! I've never tried curbside pickup, but it sounds awesome! And no impulse purchases so that's great.

Rachel

Wednesday 9th of November 2016

The end cap is forever my weakness!

Christine

Thursday 10th of November 2016

Haha, at least you know! ?

Kate

Wednesday 9th of November 2016

Great ideas I want to implement