Sinking funds are savings accounts that you regularly put money into so that you can gradually save up for a big bill or expense. Sinking funds are especially helpful when you’re on a tight budget and don’t have enough extra cash in a given month to cover a large expense such as an expensive car repair or hospital visit.

For most people living paycheck to paycheck, it is hard to come up with enough money to pay for these large expenses. That’s where sinking funds can help.

Sinking funds are a vital part of my budget. They help keep our monthly budgets pretty much the same even though our spending may vary greatly. An extra $240 in December to buy Christmas presents can be hard to swallow. However, by making it part of our monthly budget with a sinking fund, I can easily save $20 per month all year long.

How do sinking funds work?

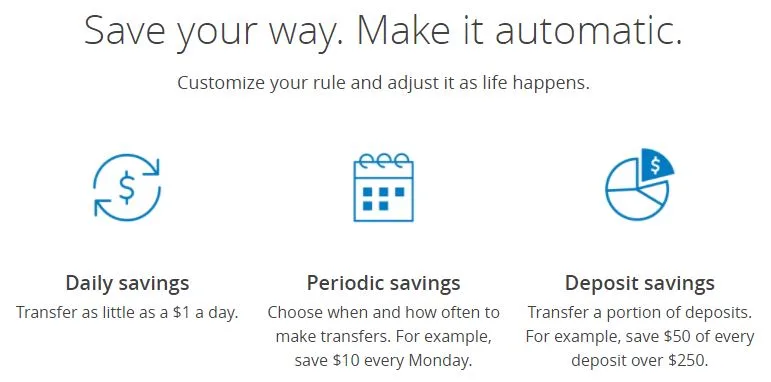

There are several ways you can go about it. You can set aside some cash, or transfer money to a savings account. I recommend setting up an automatic withdrawal every month that takes money from your checking account and automatically adds it to a separate savings account. When you do an automatic withdrawal, you don’t have to think about setting money aside for your sinking funds. It will become a natural habit for you to build up your savings or sinking funds to be able to handle emergencies or large bills.

Most banks today offer automatic transfer options. For example, Chase offers the following options: 1) Daily savings: transfer as little as $1 a day, 2) Period savings: for example $10 every monday, and 3) Deposit savings: for example save $25 of every deposit over $250. That’s a lot of great ways to get started with your sinking fund. See the image below from Chase.

When you setup automatic withdrawals into a separate account, you don’t see the pot growing. Then, if an emergency comes up, you will be pleasantly surprised to see how much money you have already saved in your sinking funds.

If you’re wondering about the logistics of how to set money aside for sinking funds, check out this post about three methods you can use.

What expenses should you save up for?

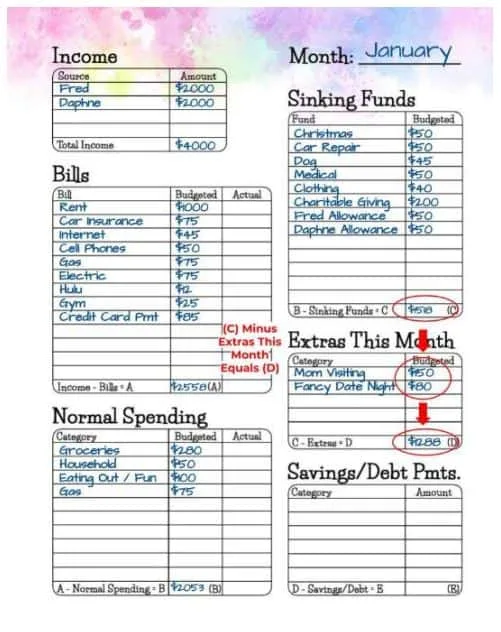

I have made a list of the 18 sinking fund categories we regularly contribute to. Most of the time, the amount is not huge, but it adds up over time. I do my best to save up for car repairs and other bummer expenses, because we know they will eventually happen. Check out below the 18 sinking fund categories that I account for in our budgeting.

18 Sinking Fund Categories You Might Need in Your Budget – The (mostly) Simple Life

How do sinking funds appear in a personal budget?

You can save up for Christmas, a new car, car repairs, birthdays, new clothes, annual bills, etc as part of your personal budgeting exercise. Sinking funds are extremely helpful in keeping your spending about the same every month. Our budget doesn’t look all that different in April than it does in December because we are adding money in our sinking fund all year long to be able to fund these expenses. Here is also a quick look at how I incorporate sinking funds in my personal budget.

You can learn more about sinking funds and personal budgets in our article: An easy way to create your first personal budget (with a free cute template) – The (mostly) Simple Life