By Jessica, writer on The Mostly Simple Life.

I know all too well that when you are drowning in your bills and receipts, it can be really difficult to start budgeting.

But knowing how you spend your money and proactively managing it is the first step to your financial success. Our personal budget category on The (Mostly) Simple Life has plenty of real-life examples as well as budgeting tips and templates.

In this article, we will keep it simple and show you how to make a budget in 3 easy steps. I will show you here simple ways that you can use to organize your expenses and be on your way to create your first budget.

So let’s get started!

Step 1 to make your budget: Get a list of your expenses

Getting a list of your expenses may not be the most glamourous part of budgeting, but reviewing and understanding all your expenses is the most important step. It will help you REALLY understand your finances and what goes in and out of your bank account.

It is also usually an eye-opening exercise as most people are able to find significant ways to save more money after reviewing their expenses.

So how do you do this ?

- Review your recent credit card expenses and bank account history (last ~ 2-3 months). See our instructions on how to get your credit and debit card expenses.

- Write down all the occasional major expenses you had to deal with in the last year or expect in the following year. Yours may include car repair, holiday gifts, kid’s orthodontia, tuition, semi-annual car insurance, vacation, or purchases of electronics. Think about the expenses that pop up a few times per year that you don’t plan on.

- To make sure you haven’t missed anything, review our example budget.

Step 2 to make your budget: Write down your budget categories on a notepad or spreadsheet

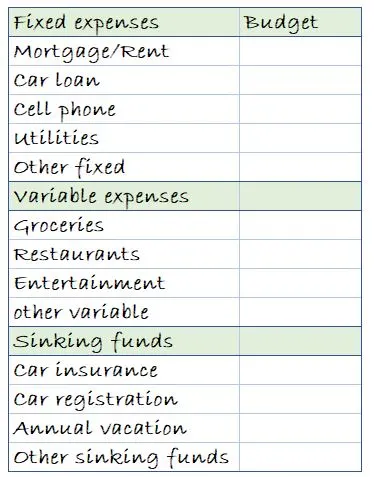

Here is how my first budget categories were organized in my budget Excel spreadsheet. I categorized your expenses in three buckets : fixed expenses (same expenses every month, such as rent), variable expenses (expenses that change every month), and Sinking funds that only happen a couple of times per year but that you need to account for in your budget.

Step 3 to make your budget: Group your expenses by category

It will be impossible to understand how you spend your money if you have to analyze every single transaction, so we recommend grouping your expenses to make your budget. For example, add up your car repair, maintenance and gas under a “car” budget category.

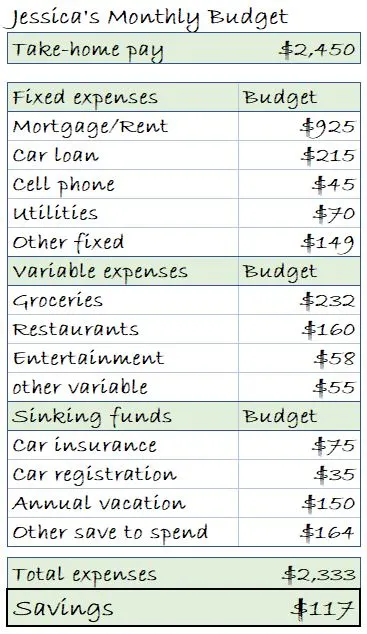

Here is a copy of my first budget with total spending for each category :

And voila ! You can make a similar budget in an hour or two. That’s already a great step to understand how you spend your money.

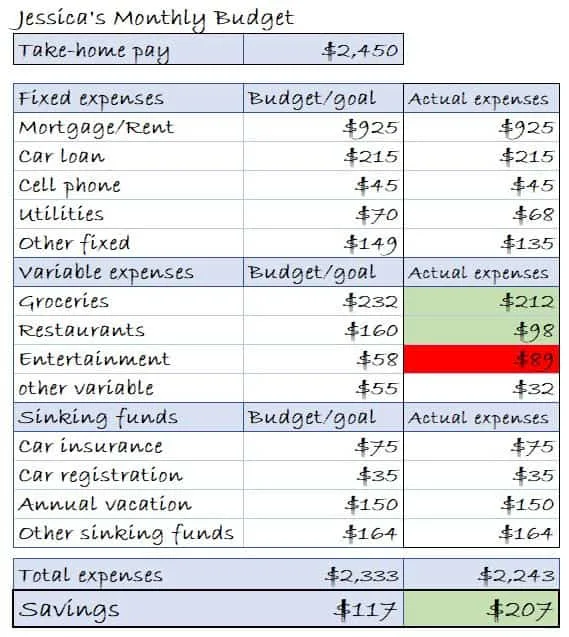

I also found it useful to have a column of what I actually spent, versus what I should spend. See image below. Because i had set a goal for a few of these categories, I was able to better control my expenses (hello groceries and restaurants!) to increase my savings from about $100 a month to over $200 per month. That’s still not much, but it’s a good start.

You can now review how much you spend per budget category, how much you are able to save, and where you should reduce your expenses. This exercise should be super helpful to understand how you actually spend your money, and where can you save a lot of money.

I recommend you set a “budget goal” for some of the top categories. For example, after this new budget creation exercise, you may find out that you need to set a budget goal of $55 per week for groceries and $25 for restaurants and take-outs. Having a number in mind will help make better purchasing decisions.

So what’s next?

You are now already 80% of the way to improve your finances.

If you are ready to take it to the next level, you will enjoy the following articles:

- An easy way to create your first personal budget (with a free cute template)

- 6 tips to budget your money when you earn $2,000 to $4,000 per month