After Ben and I got married in 2014, we were earning two incomes, but we also had debts, and started to have to pay for all those adult expenses that have a way of syphoning out all your money. So I taught myself how to make our own budget DIY, understand our expenses and save more money. With our first budget, we understood why we were able to save only ~$40-50 per month.

From Living Paycheck to Paycheck to Saving Money

We used to live paycheck to paycheck, putting very little money aside. However, over the years, I have improved my budgeting skills and was able to learn exactly where our money was going. We were eventually able to pay off most of our credit cards (over $15,000); buy our house as well as a rental property; save enough money to live a comfortable life. I am well aware that it can feel impossible to start budgeting when you’re trying to figure out how to stop feeling like you’re drowning in your bills and you can barely cover your monthly expenses. That’s why I started to write about our own personal experience so that (hopefully) other people can learn from it.

Our First Budget

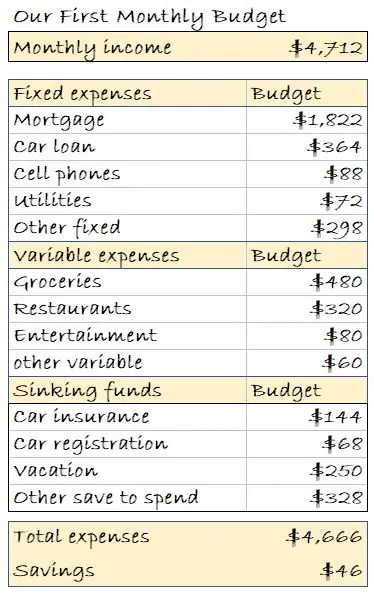

Below is the FIRST budget I put together for Ben and I. The image below is a simplified version to read on a mobile phone.

I used an Excel spreadsheet and classified all our expenses in three buckets: “Fixed expenses” (the amount is roughly the same every month), “Variable expenses” (expenses vary month to month) and “Sinking Funds” (Big expenses happening once in a while, such as a car or home repair).

And, ooops, as you can see on the image above, our savings were only $46 per month in this first budget! Our budget exercise clearly explained why Ben and I struggled to keep our bank account afloat and couldn’t pay down debt faster.

So let’s see now in more details how we created our first budget, with our recommendations on how to get this whole process started.

4 simple steps to make your first budget

I will try to make it as simple as possible. How can you get started with your first budget? I put together this step by step guide so that is as easy as possible for you to create your first budget:

1. Start with Your Expenses

You must first inventory all your expenses. And i mean all your expenses. It doesn’t matter if you’ve paid for them by credit card, debit card, check, Apple Pay or even by cash. So how do you do that?

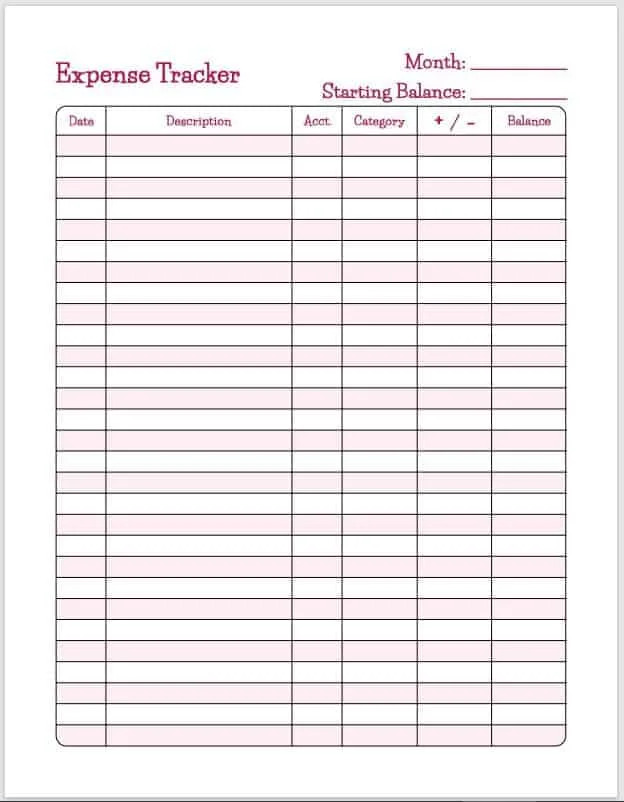

Start small. What matters is that you get started. You can us a simple notebook or an expense tracker. You can view/download my Expense Tracker if you want to use an expense tracker printable (see screenshot below). If you need a bit of help to figure out how to get a list of your expenses from your credit card or bank account, read our article: How to get your expenses from your online credit card or banking accounts.

The process of gathering all your expenses usually takes time (about 1-2 hours) but it is critical to help you understand exactly how you spend your money.

2. Decide Where You Will Keep Your Budget

Once you have a record of all your expenses, you will be able to make your first budget. The next step is to decide where you are going to keep your budget.

If you are a computer person, you will probably want to use an Excel or Google Spreadsheet. If you are a pen-and-paper person like me, you can use a simple paper budget. Here are the main options::

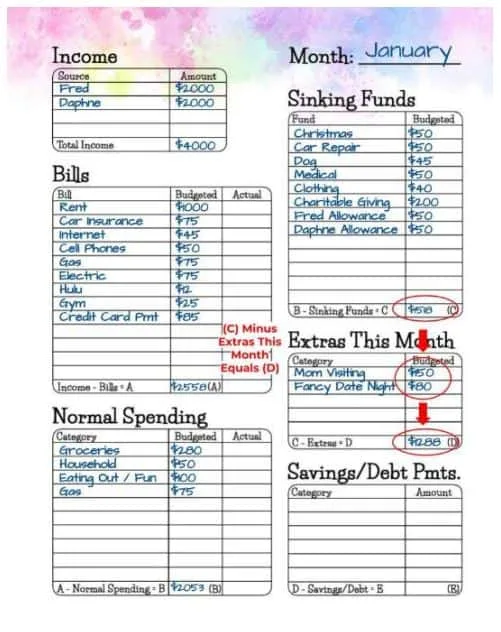

- Budget printable: If you like to do things on paper to keep it simple, you can use a budget printable, such as our budget printable below (Download PDF here). You can use this printable to list all your expense categories (rent, cars, utilities, etc) and how much you spend on each every month. This will give you a good sense of where your money is going.

You can also list your “sinking funds”, which are expenses that don’t happen every month but have a big impact on your finances in any given year (For example, car repairs or Christmas gifts). It’s very important that you have a list of sinking funds so that you don’t get any bad surprises. You don’t want bad surprises with your finances!

- A spreadsheet on your computer (Excel or Google Sheets). Microsoft has several Excel budget templates (See this link).

- Online budgeting tools like QuickBooks or apps like “You Need a Budget” (YNAP – an app that’s free for the first month). If you are ready to take it to the next level, you can use these tools to start keeping track of your budget every month.

Ok, now that you know where your budget will live… on to creating your budget!

3. Write Down Your Budget Categories

It’s time to inventory all your “budget categories”, such as groceries, cars or restaurants.

Most budget categories will contain several types of expenses. For example, the “Cars” budget category will contain gas, car repair, tire replacements, oil changes and even parking or speeding tickets (we never get those!!). There are a lot of different kinds of budget categories so you want to make sure you don’t miss the big ones. A budget will only work well if it’s COMPLETE.

I’ve listed below the categories used to create our own budget:

Housing

- Rent or mortgage

- Home repair

- Home insurance

- Services: Snow Plow, Lawn, Termite Inspection…

Cars

- Car Registration/License Renewal

- Oil Changes

- Tires

- Maintenance & Repairs

- Parking Fees / Speeding or Parking Tickets 🙄

Medical

- Copays

- Prescriptions

- Deductible/Out-of-Pocket Costs

- Over-the-Counter Medications

- Vitamins

Holidays

Obviously Christmas and Thanksgiving, but don’t forget Halloween, Easter, and Valentine’s Day too!

- Food

- Gifts

- Cards + Postage

- Decor

- Travel

Birthdays

- Party: Decorations and Food

- Going Out to Eat

- Gifts: For family, friends, kid’s friend’s birthday parties…

Once or Twice Per Year Costs (Great for your sinking funds).

- Vacations!

- Life Insurance

- Home Owners Insurance

- Car Insurance

- Property Taxes

- Magazine Subscriptions

- Memberships: Zoo, Museum, Water Park…

Kid Stuff

- Babysitter

- Activity Fees

- Daycare

- Field Trip Fees

- Growing Out of Clothes and Shoes

- Sports Fees & Equipment

- School Supplies

- Day Camp/Summer Camp

- College Savings

Clothing & Shoes

Charitable Giving

Gym / Fitness Class Fees

Haircuts

To learn more about budget categories and make sure you did not forget anything important, check out Christine’s post on 55 Budget Categories You Don’t Want to Forget.

4. Assign a Dollar Number fo Each Category

For each budget category, you should assign a number – how much you’ve spent, per week or per month, for each “budget category”. Use your best estimate for each category, track down your receipts or review your credit card expenses or bank account expenses history. Review all your expenses for the past 2-3 months because not all expenses will happen every month.

How do you account for rare – but big – expenses like a car repair?

Those expenses are listed in the “Sinking Funds” category in your budget. For “Sinking Fund” expenses, I break up the estimated annual spending into small amounts that I fund each month. For example, for “Car Maintenance,” I know that I won’t have to have my car worked on each month, but it will be costly when it breaks down or needs maintenance. So, I set aside $110 each month to fund it easily when I need to. This means that annually I put $1320 into my “Car Maintenance” sinking fund / budget.

Once you have done all this (not so fun!) grunt work, you are ready to reap the rewards.

5. Start Saving!

Now that you know exactly how much of your money is being spent, and HOW it is being spent, you can take control of your finances. With your budget, you now know exactly how much you are spending per category and where you should cut. I recommend starting by setting a “budget amount” (maximum allowed spending) for some of your top categories where you know there is room to cut. Set a number and stick to it.

For example, I recommend that you set a target for “grocery spending” and go shopping with that number in mind. It will help you make smart choices and motivate you to spend LESS. You will suddenly find new ways to save money on groceries because you will be motivated to meet your budget goal, and because it feels great when you do so.

If you go over budget, you know you need to make it up next time you go shopping.

You can also brainstorm with your spouse or friends new ways to cut expenses on your top-spending categories. Read our post on how to use a budget to save an extra $5,000 per year to get some inspiration.

If you are ready to take it to the next step, you can also review our best budgeting tips to take it to the next level.