In my early 20’s, I stayed at my parents and worked as a nanny for a family, where I took home $300 per week. I was sure that I was living a life of true luxury. My weekend was spent going out with friends, buying drinks for everybody I met, and buying whatever clothes I felt like (even if that meant $90 jeans at Nordstrom). I was certainly not yet thinking about the best ways to budget my money.

After I got married, we started balancing two incomes, a mortgage, bills, and those adult expenses that can be a total bummer. I taught myself how to budget money without consulting any resources, and it was messy. Our budgets were written out on scrap pieces of paper, without a plan or any future preparation.

Over the years, I have refined my skills with money and budgeting. We have been able to pay off multiple credit cards and a student loan (totaling over $25,000), purchase a rental property and build our savings accounts to a number that allows us to live a comfortable life. All of this on individual incomes of less than $4,000 per month each.

I know all too well that when you’re trying to figure out how to stop feeling like you’re drowning in your bills, that it can feel impossible to start budgeting with your money. That’s why I have compiled my best budgeting tips when you’re making between $2,000-$4,000.

If you are new to personal budgets, you can also review our simple articles on getting started with creating your first budget, including Simple Budget Categories: Just 3!. To get some inspiration, you can view Christine’s frugal budgets here on how to live on $2,500 per month or how to live on $1,500 per month.

Money budgeting tip #1: Pay yourself first… even if it’s $10 a week

Set an automatic withdrawal into a separate savings account to build your emergency fund or savings account. When you do this, you don’t have to think about setting money aside for savings. It will become a natural habit for you to build up your savings account, meet savings goals, or save towards a larger purchase.

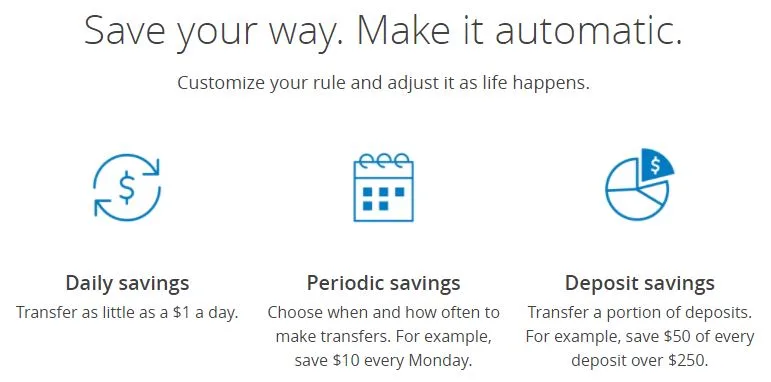

The great news is that many banks offer automatic saving options. For example, Chase offers several options as part of the Chase AUTO-SAVE program:

1) Daily savings: transfer as little as $1 a day.

2) Period savings: for example $10 every monday.

3) Deposit savings: for example save $50 of every deposit over $250

(see image below).

When you deposit that automatic withdrawal into a separate account, you don’t see the pot growing. Then, if an emergency comes up, you will be pleasantly surprised to see how much money you have already set aside!

I recommend that when you first begin budgeting to make this withdrawal amount small enough that you don’t notice it’s absence. While it would be great to set $500 aside each paycheck, for most people making between $2,000-$4,000 per month, this isn’t feasible. Instead set up an automatic withdrawal for between $20-$50 per paycheck.

Money budgeting tip #2: Break up high-spend categories into smaller categories

Take a look at your expenses and budget to see where you consistently overspend. For most Americans, this category is eating out. If you find yourself eating out and consistently overspending your budget, break up the category into more manageable pieces.

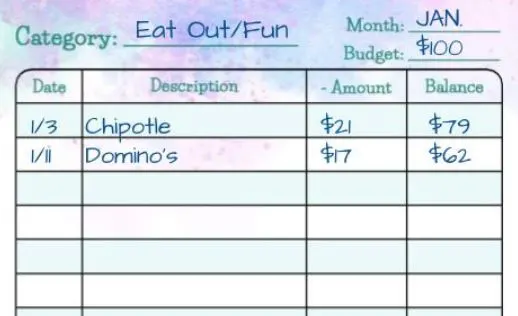

Here is below an image of how you can set a budget for a high spend category (“eat out/fun: $100 budget”) and start tracking your expenses to make sure you don’t go over budget.

For us, we even break up our food budget into weekly increments (Week 1, Week 2, Week 3, and Week 4). That way, we know that if we overspend in a week, we have to slow down the following week to pay back what we overspent). Set a weekly budget target for eating out (for example, $40 per week), so that you know you need to start eating in more regularly when you overspend.

Maybe you have another category that you consistently overspend (like buying new clothes, guilty again!). You can start by setting yourself a monthly goal to stay below $80. Having a monthly number in mind can help you keep your expenses in check.

Money budgeting tip #3: Identify your triggers

If you’re anything like me, then there are certain places (cough cough Target) that you can’t go into without picking up some things that weren’t on your list. This is especially unavoidable if I have had a hard week or need a pick-me-up. They don’t call it retail therapy for nothing, right? When you can identify your triggers, you can budget for them accordingly.

If you know that you like to buy new lotions when you go to Target, set aside $20 in your budget to spend when you go to Target. If you know that when you have a rough day at work, you like to pick up a chocolate croissant at the local coffee shop, set aside $10 in your budget.

your budget to avoid surprises

Money budgeting tip #4: Take advantage of any incentives for paying in larger increments.

When you don’t earn a lot of money, it’s harder to take advantage of the discounts offered with pre-payment options. But that’s why it is even more important that you plan for it. You can often save as much as $100, $200 or even $300 by pre-paying instead of paying every month.

For example, our insurance gives us a considerable discount for paying our premiums twice a year as opposed to monthly. By doing this we save around $300 per year, so it’s incredibly important to us to take advantage of that benefit.

Look at your bills and see if there are ways to reduce your bills’ overall cost by paying larger increments. For example, add an extra $25 per month to your automatic monthly withdrawals (see budgeting tip #1) for the purpose of paying your insurance bills twice a year as opposed to monthly. It has a double benefit, as it also puts the money saved in your savings account to bolster your emergency fund.

Money budgeting tip #5: Give yourself grace

When we were first starting to budget, we fell madly in love with Dave Ramsey’s principles. We attempted to implement them into our lives as much as possible. However, we learned that often times, Dave encourages making sacrifices to make your budget work. These sacrifices mean not eating out, not having date nights, or canceling a costly membership.

We found that when we eliminated all of those things that brought us joy, our quality of life went down too. We could no longer go out to lunch with our friends on the weekend because it wasn’t in the budget. We weren’t taking intentional time together because our date nights had to happen at home. What we know now is that many of these categories need to be reviewed but not necessarily eliminated. Instead of taking away dining out budget, just adjust it so that you can go out to eat twice a month instead of six times per month.

If you enjoy fancy date nights out, plan to have one date night every other month (instead of multiple times per month). When you make these adjustments, you don’t have to sacrifice your joy in the process.

Money Budgeting tip #6: Compare your budget

Compare your budget with the budget of other people with a similar living situation and income. This will probably help you identify areas where you overspend. You can view Christine’s frugal budgets here on how to live on $2,500 per month or how to live on $1,500 per month.

You might also get some inspiration from Elly and Jessica’s story, who worked on Elly’s personal budget to save an additional $5,000 per year (Household income of $60,000 for two people). You can also view all our Budgeting resources.

We would love to hear your thoughts. Let us know in the comments what you think!

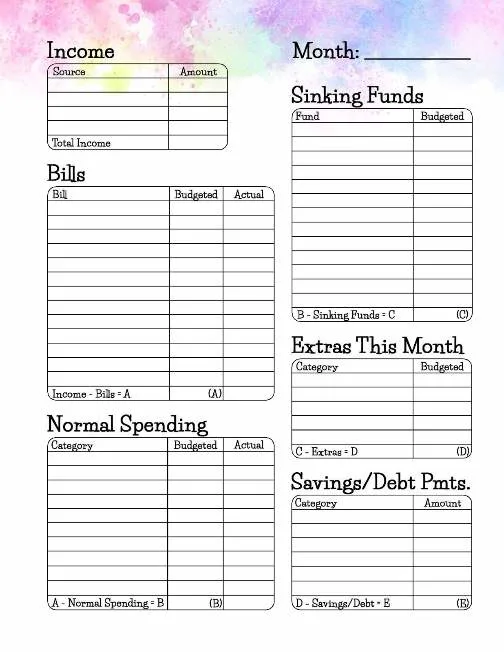

Download this personal budget template to create YOUR first budget

Budgeting and investing for success: a woman’s simple guide to financial freedom - The (mostly) Simple Life

Sunday 29th of November 2020

[…] manage your finances? Our page on Personal Budgets is a good place to start. You can read tips to budget your money and view several household budget examples to help you get […]