Create Your Personal Budget to Take Control of Your Money

We are here to help you create your first personal budget and learn budgeting tips that can help you save real money. We provide simple examples of real-life budgets and easy-to-use Excel personal budget templates to help you make your first budget.

Why is a personal budget so important?

Budgeting your money is so important because you will be able to see how much is going in-&-out, and find new ways to save money. Senator Elizabeth Warren stated “Budgeting your money is the key to having enough”. Read my post on the 4 golden rules of saving money & building your wealth, with an average income.

Monthly Budget Examples

When you create your own budget, it is often very helpful to compare it with other people’s budgets. We’ve started to create real-life monthly budget examples that you can use to compare your expenses (more coming soon!):

Budgeting tips to save more money

How to make your first budget

Jessica has managed her personal budget for years. We sat down to review how she got started. Read Jessica’s take on how to make your budget in 3 simple steps.

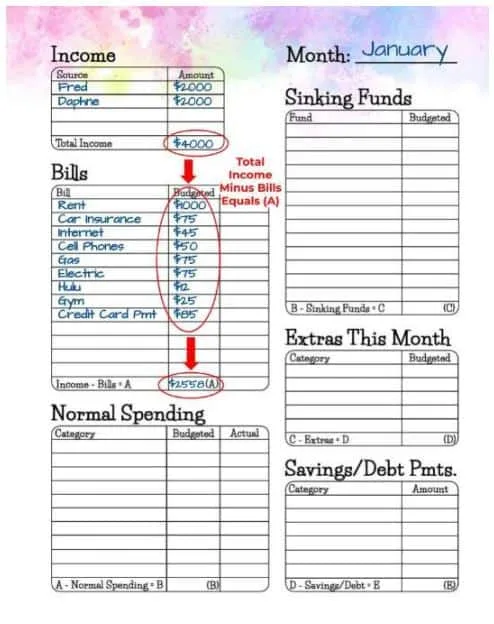

An easy template to create your first simple personal budget

We have prepared for you an easy monthly budget printable that will show you your plan for all of your money for the month. You can use the budget printable to enter your income, regular bills, and create your sinking funds.

See how to create your first budget.

THE LATEST POSTS ON BUDGETING:

- How to Make Your First Budget to Save More Money

- How to Live on $3,000 to $6,000 Per Month – See Our Actual Budget

- The #1 Rule for Success with Saving Money

- The 4 Golden Rules of Saving Money & Building Wealth, One Step at a Time

- An easy way to create your first personal budget (with a free cute template)

- Budgeting and Investing for Success: 4 rules to build your wealth

- 6 tips to budget your money when you earn $2,000 to $4,000 per month

- 9 Ways to Stick to a Budget

WHAT COULD YOU USE SOME HELP WITH?