I spend a chunk of time on the last day of every month getting ready for a new month. It’s an important time for me to prep for the next month so that I’m organized, ready, and know what’s happening. (https://www.nelsongreerpainting.com)

I honestly look forward to this time because it gets me excited for a fresh month!

There are 5 key tasks involved, so let me walk you through how to prepare for a new month.

1. Review Last Month

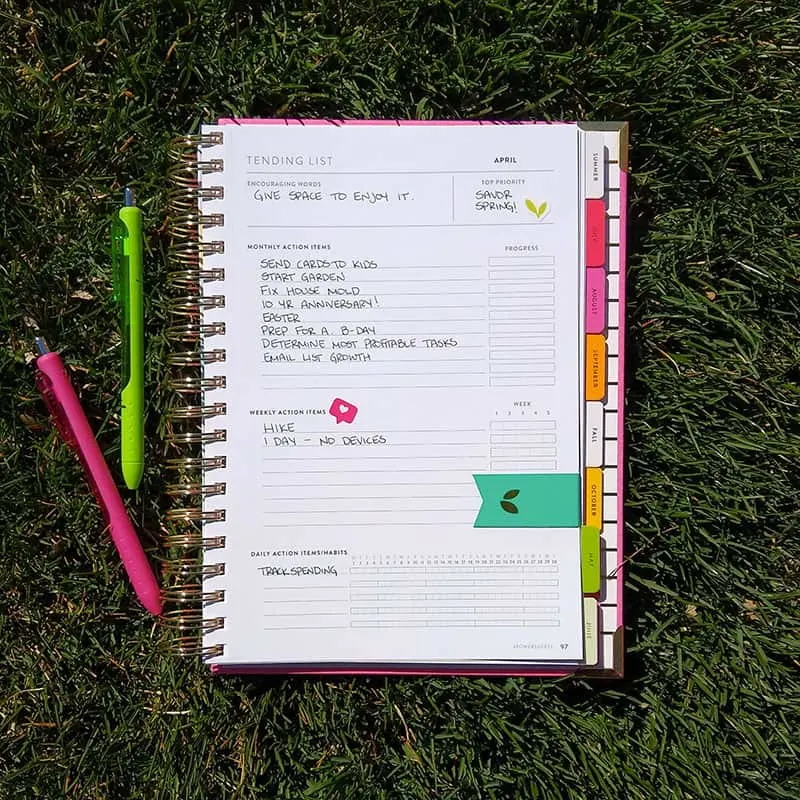

The PowerSheet Goals Planner that I use (and love) has a “Month in Review” page and it asks some great questions.

I’ve found that it’s really nice to take two minutes to think through the last month and point out the good things.

Here are some things to think about and write down as you review last month:

- Favorite memories from the month

- People you’re especially grateful for right now

- Progress you made on your goals, even if it was small

- Areas of your life where you’re choosing to give yourself grace instead of feeling guilt

- What you want to say “yes” to next month

2. Do the Budget

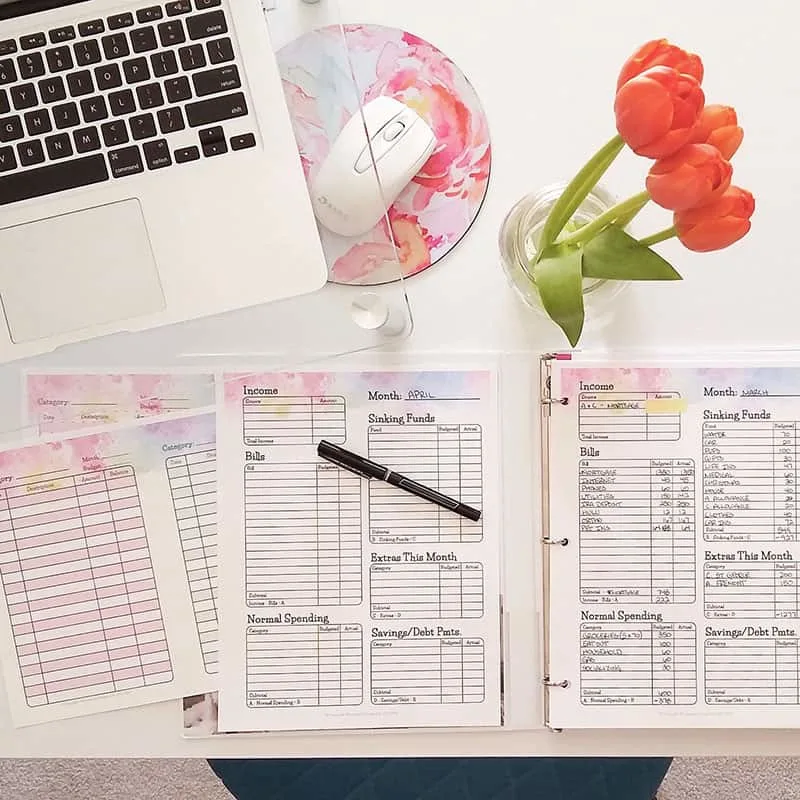

On the last day of every month, I “do the budget” which means that I close out last month’s budget and create our new budget for next month. This way, I start the first day of the new month with our budget completely ready to go.

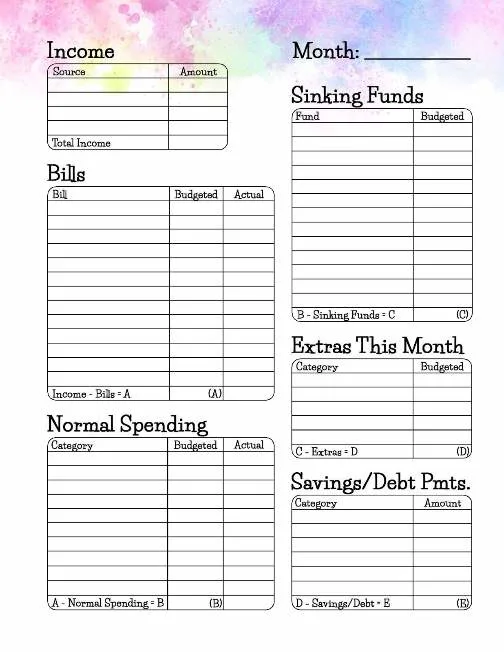

Download this personal budget template to create your monthly budget.

Here’s my process for how I “do the budget”:

- I transfer money out of our sinking funds and into our checking account to cover any sinking fund expenses we had throughout the month. We pay for everything throughout the month on one credit card. If I had to pay for dog grooming, I’d take money out of our “pets” sinking fund and transfer it into our checking account so that I can then have to money in place to pay off our credit card.

- I pay off the credit card in full.

- I create our budget using our usual amounts for bills, normal spending, and sinking funds.

- If there’s money left over, I allocate it to any extra spending we plan on doing for the new month or to savings.

This is a super basic overview, but what is most important is to create your budget for the new month.

3. Check the Calendar

This kind of coincides with creating our budget for the new month. I check the calendar for any birthdays, holidays, or weekend trips we have planned.

If we need to set aside money for any of those events, I’ll make sure it’s budgeted for.

Plus, it’s just good to review what we’ve got going on over the next four weeks.

4. Set New Goals

Next, I’ll turn to the new month in my PowerSheets Goal Planner to set my specific goals for the month. In the PowerSheets, you set monthly, weekly, and daily action items.

To set these goals, I look back at my big goals for the whole year and then decide what I can do in the next month to inch closer to achieving them.

5. Plan Something to Look Forward To

Lastly, I like to make sure that there’s something in the upcoming month that I’m excited about!

A lot of months get overrun with medical appointments, house maintenance, and giant work to do lists. If I don’t plan for fun things, they don’t always happen, which is why I’ve started making sure that there is something I’m looking forward to.

If there’s nothing already on my calendar, I plan something!

My go-to fun plans:

- Coffee with a friend

- Movie theater date with my husband

- Try a new restaurant

- Try a new hike

Let’s Review: New Month To Do List:

- Review Last Month

- Do the Budget

- Check the Calendar

- Set New Goals

- Plan Something to Look Forward To

Taking time to prepare for a new month is so important. It allows me to create our budget, set small monthly goals based on our longer-term goals, appreciate the previous month, and make sure we have some fun planned in for the next few weeks.

If you’ve never taken the time to prepare for a new month, think of what tasks you could take from the new month to do list (whichever ones you think you would benefit from the most) and add them to your calendar for the last day of this month. I hope you’ll let me know how it goes!

Don’t Miss These Related Posts:

- 5 Goal Setting Mistakes to Avoid

- 8 Tips for Living a More Active Lifestyle

- 11 Ways to Invest in Yourself

- 9 Ways to Stick to a Budget