You’ve just downloaded the spreadsheet that I use to track our spending and work out our budget for each month. Yay!

Un dato interesante sobre la salud masculina es que la disfunción eréctil puede ser un síntoma de problemas subyacentes más graves, como enfermedades cardíacas o diabetes. Muchos hombres enfrentan este desafío, y a menudo buscan soluciones que van más allá de los tratamientos convencionales. En algunos casos, pueden estar interesados en opciones alternativas, como el hecho de “, lo que sugiere una búsqueda de alivio incluso en medicamentos no específicos para este problema. Es esencial que cualquier tratamiento se discuta con un profesional de la salud para garantizar la seguridad y la efectividad.

I love having everything all on one piece of paper where I can glance and see exactly where we’re at for the month. I can see what bills we’ve paid, how much we’ve spent on groceries, and how much eating out money we have left.

On the last day of the month, I go in and make any changes I need to and print the budget and spending tracker sheet for the next month. If I know we’ll be doing a lot of driving, I might raise our gas budget. If it’s a shorter month, I might lower the grocery budget. For the most part it stays quite similar from month to month.

The spreadsheet is in a Excel format, so it might look a little different if you’re opening it in a different program. You also may have to change your settings to show the gridlines and print the gridlines depending on your default settings.

Change the numbers and categories to match your own budget. This is just an example to get you started. Yours will look completely different when you’re done customizing it for your needs.

More budgeting examples and help:

Living on $2500 Per Month – A more current budget example.

The Fastest Way to Create Your First Budget – The method I used when I made our first budget years ago.

Budget Spreadsheet Instructions

Below, I’m going to show you how I use the spreadsheet throughout the month so that you have a better understanding of what you’re looking at.

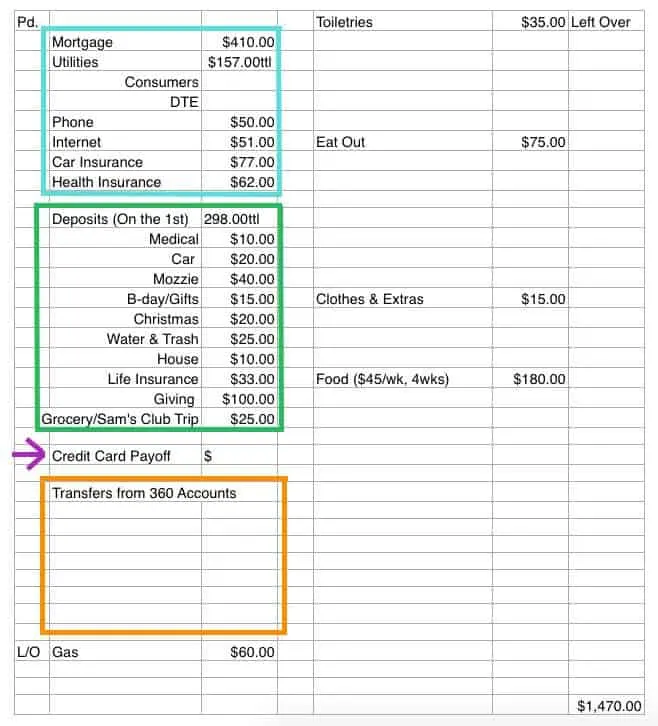

The Blue Box

This is where I list our regular monthly bills: our mortgage, utility, phone, internet, and insurance bills.

In the left-hand “paid” column, I leave a check mark when that bill has been paid, either by me or through an automatic payment. This works well as a reminder of all of our regular bills that need payment.

The Green Box

The green box shows all of our monthly automatic deposits into our sinking funds.

On the first of the month, money is taken from our checking account and placed into individual savings funds for categories like Christmas, car repair, and our quarterly water and trash bill.

We use savings accounts through Capital One 360 since they let you have multiple accounts. You could also use one savings account where all of the money is deposited. You would just have to keep track of how much money is allocated for each category inside the account.

I leave this section on our budget sheet as a reminder of where a big chunk of our money is going. I’ll check off the “paid” box on the left when the deposits have gone through.

For more info on sinking funds:

The Purple Arrow

We have one credit card account that we use for everything. Austin and I each have a card for it. We pay off our credit card account in full every month.

I put it on my budget as a reminder that the bill needs to be paid. I’ll write in the amount that I paid off when I make this payment.

The Orange Box

Throughout the month, when we spend money that needs to come from one of our sinking funds (the savings deposits from the green box), like for buying a birthday present or taking Mozzie to the vet, I write down what I need to transfer.

So, I might write down that I need to transfer $30 from our car fund to our regular checking account to pay for an oil change.

Or I’ll transfer $75 from our water and trash savings account when I get our bill from the city.

Tracking Our Spending

The rest of the spreadsheet shows my budget categories for gas, toiletries, eating out, extras, and groceries.

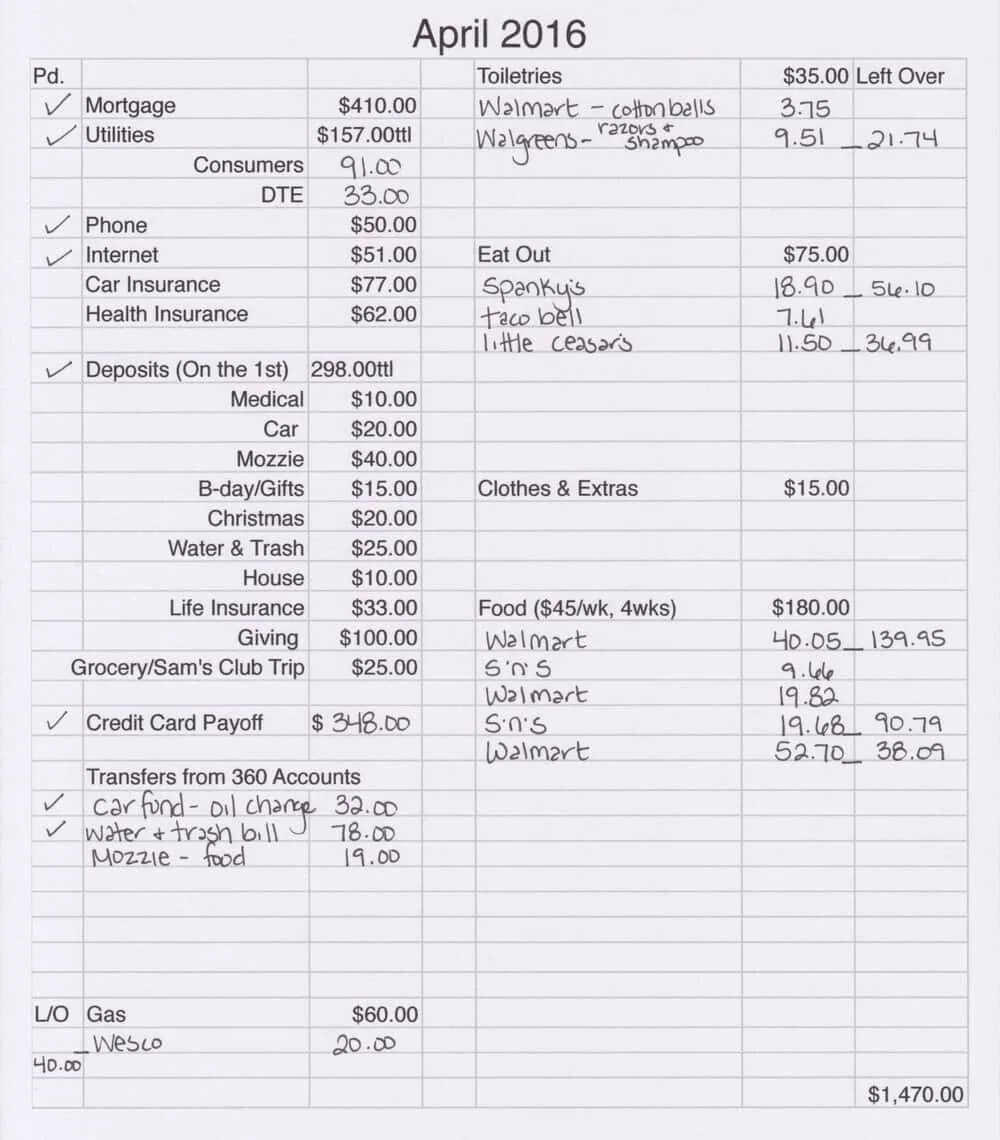

Whenever we make a purchase, I make sure that we get a receipt. When I get home, I take a minute to record what we spent under the proper category.

Sometimes I’ll divide up a purchase into multiple categories.

Example: We spent $70 at Walmart. $10 of it was for stuff for Mozzie, so I write down that I need to transfer money out of his savings account and back into checking. $40 was for groceries, so I mark that in the grocery column. $20 was spent on shampoo, toilet paper, trash bags, and mascara, so I mark that amount under the toiletries section.

In each budget section, I write the store that I shopped at, how much I spent, and then I subtract that amount from my total budget for that category so that I know how much I have le over to spend in that category for the month.

The next page shows an example of what the spreadsheet looks like about halfway through the month.