My parents set a good example for me financially (for which I am incredibly grateful). I remember my mom pulling out a special black binder every month that had all of their ledger sheets in it where they would track their spending and bills. And of course, being organizationally obsessed, I was fascinated. I would take the change out of my piggy bank and divide it into different piles that I planned on using to spend on various things (usually stuffed animals).

My parents set a good example for me financially (for which I am incredibly grateful). I remember my mom pulling out a special black binder every month that had all of their ledger sheets in it where they would track their spending and bills. And of course, being organizationally obsessed, I was fascinated. I would take the change out of my piggy bank and divide it into different piles that I planned on using to spend on various things (usually stuffed animals).

We’ve lived below the poverty line and we’ve lived with enough to pay our bills with some left over for fun stuff. No matter how much we’ve made (or didn’t), we’ve tried to keep a budget and track our spending.

I absolutely believe that everyone needs a budget.

Yes, YOU.

You Need A Budget If You Hardly Make Enough To Get By

I’ve had people tell me that they don’t make enough money to have a budget. I find this argument somewhat mind boggling. It’s really quite a hopeless view of your finances. It may seem like every month you barely have enough to buy food and pay the bills, and that might be true, but maybe by tracking your spending and setting limits with a budget you will see where you can carve out a tiny bit of wiggle room.

Some people swear that they don’t make enough money to get by, but when they track their spending they realize they’re spending $200 a month on eating out that probably isn’t necessary. Maybe you’re spending a few extra dollars on snack foods every month that you could cut out or replace with something less expensive. Then all of a sudden you have $5-10 dollars extra to save or use to pay down debt. For most people, I can almost guarantee that there is a way to reduce your spending to free up a few extra dollars that you didn’t think you had.

When we were barely getting by, keeping a budget put us in control of our money. Instead of living in fear of how we would pay a bill coming up or buy groceries, we could make a plan and see it all set out on paper. Our budget was very tight and took some major sacrifices to make it work, but it was better than living in fear and not really knowing what our financial state was.

I remember one time when things were rough in the first year we were married, I made up our budget and actually had $20 dollars extra that wasn’t needed for bills! In my budget I set this money aside for us to go out to eat (a special treat that we couldn’t normally afford). It was so exciting to find money to set specially aside for something fun. And I didn’t feel guilty spending money on a special treat because that’s what the money was budgeted for!

You Need A Budget If You Make More Than Enough To Pay You Bills & Buy What You Want

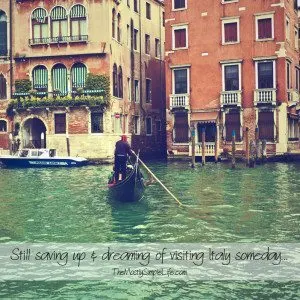

Okay, so you make enough money to not really worry about how you’re spending it. That’s awesome! Why do you need a budget? Well, it’s time to set some goals (maybe some goals you thought were outside of your reach) and see how much you can achieve! So, you’ve got a car payment but it’s no big deal because you make plenty of money to cover it, no problem. Well, if you were on a budget, maybe you could pay that car off in a few months and have even more money to work with! Maybe you live comfortably, but think that a big, huge, dreamy vacation is out of reach (I’m still saving hard to go to Italy someday!). If you set up a budget and track your spending, I bet you could save up enough to make that dream a reality!

Okay, so you make enough money to not really worry about how you’re spending it. That’s awesome! Why do you need a budget? Well, it’s time to set some goals (maybe some goals you thought were outside of your reach) and see how much you can achieve! So, you’ve got a car payment but it’s no big deal because you make plenty of money to cover it, no problem. Well, if you were on a budget, maybe you could pay that car off in a few months and have even more money to work with! Maybe you live comfortably, but think that a big, huge, dreamy vacation is out of reach (I’m still saving hard to go to Italy someday!). If you set up a budget and track your spending, I bet you could save up enough to make that dream a reality!

If you’re doing just fine without really trying, think of all that you could accomplish if you payed attention!

You Need A Budget If You’re A Saver

I’m a saver. It’s a security thing, I’m sure. I’m so much less stressed when there’s extra money in the bank and everything is payed for. My husband has to remind me that we should probably each get a little bit of “fun money” for the month. If you’re naturally a saver, you may not think you need a budget because you just save as much as you possibly can no matter what. Yes, saving feels good. But it’s also important to loosen up a bit and have planned splurges. If you put in your budget a section for fun money, well then you have money set aside to use for your enjoyment! You don’t have to stress about spending that cash because it’s there to be spent on something fun. It’s awesome to feel safe and secure in your finances and to make responsible decisions, but it’s also important to have balance in life and enjoy yourself!

You Need A Budget If You’re A Spender

Usually spenders are the most resistant to living on a budget. They most often think it’s too restrictive.

First of all, you’re an adult and should live with some amount of self-control and discipline… just sayin’.

Secondly, it’s your budget. You get to allocate your money however you choose to! I would of course suggest that you prioritize paying your bills and paying off debts, but after that, allocate your money however you want. Set some goals to save up for big, fun purchases if you want to. If you want to spend 0 dollars every month eating out and you make enough money to do so, go for it! (Zolpidem)

Everyone has different priorities with their money. The point is that when you have a budget, you know where your money is going and you are in control. Don’t just get to the end of the month and wonder where your hard earned money went. Spend it on purpose, in a way that helps you achieve your goals.

⇒Do you have a budget? Are you a saver or a spender?

Subscribe to my posts via email in the right column so you don’t miss anything!

Home Internet Careers University

Saturday 20th of February 2016

Please let me know if you're looking for a author for your blog. You have some really good articles and I think I would be a good asset. If you ever want to take some of the load off, I'd absolutely love to write some content for your blog in exchange for a link back to mine.

Please shoot me an e-mail if interested. Regards!

Latasha @ ArtsandBudgets

Thursday 11th of February 2016

Awesome post!!! Budgeting has helped me pay off a ton of debt and accomplish a lot of pay off goals. :)

Christine

Thursday 11th of February 2016

Thanks Latasha! Great work!

lolobunny

Sunday 7th of February 2016

This is a great post. After three years of living within our means, we're still discovering ways to save. What started as a necessity has now become something, dare I say it, a little fun? ;)

Christine

Monday 8th of February 2016

That's awesome! I totally agree! I kind of enjoy the challenge of making our budget work and seeing how much we can save.

Mel @ brokeGIRLrich

Sunday 7th of February 2016

I don't really budget much, but I have over the years and found that even if you hate it - it's still worth doing for periods of time to get a handle on where your money is going. Once your spending habits are ingrained, I don't think you have to stay 100% on top of updating it, you can just check up on your budget goals once in a while and get on with life.

Christine

Monday 8th of February 2016

Thanks Mel!

Charissa

Saturday 6th of February 2016

I have found that budgeting is a tool to help me accomplish my financial goals. However, it wasn't until I realized what my Why was, my reason for budgeting, that budgeting became helpful instead of something that just stressed me out.

Christine

Saturday 6th of February 2016

Thanks Charissa! That's awesome! Budgeting is really all about setting your own priorities and being able to accomplish what you want to. I think people get hung up in what they think they're supposed to do.